Why Estate Planning is the Cornerstone of Holistic Financial Planning

Holistic financial planning is one of the most talked-about trends in wealth management today. Advisors everywhere are rebranding themselves as “holistic” in an effort to show clients they do more than manage portfolios. But can an advisor make this claim without also implementing estate planning? We say without adding this to your list of services, the holistic claim falls flat.

Estate planning is the one discipline that brings all parts of financial life together. It ensures wealth is preserved, transferred, and aligned with a client’s values long after investment returns fade from memory. In this article we answer the most common questions advisors ask about integrating estate planning into holistic financial planning.

What does holistic financial planning really mean?

Holistic planning is more than building a diversified portfolio. It includes retirement income planning, tax efficiency, insurance coverage, healthcare, and estate planning. True holistic advice shifts the advisor’s role from investment manager to life partner.

As Axtella’s wealth planning manager recently highlighted, advisors must “fully embrace comprehensive financial planning that goes beyond investments”.

Why is estate planning the cornerstone of holistic financial planning?

Estate planning is where financial strategy and family legacy meet. It ensures wealth transfer aligns with a client’s intentions and protects families from conflict, confusion, and costly legal disputes. Without estate planning, the holistic claim is incomplete because it ends with the client instead of carrying forward to future generations.

How does estate planning build deeper trust with clients?

Clients are not only looking for asset growth. They want peace of mind for their families. Estate conversations show empathy, which strengthens emotional trust and creates loyalty that outlasts market cycles. According to Trust & Will’s 2025 advisor report, 70% of clients expect estate planning services from their advisor, and 40% would switch to get it.

What are advisors missing if they ignore estate planning?

-

Assets walk out the door. Research shows that 70 percent of widows change advisors within a year of losing a spouse.

- Clients see a gap. The 2025 Citizens Wealth Transfer survey found that 84 percent of women feel underprepared to manage inheritances.

- The industry is crowded. Advisors who do not integrate estate planning lose the opportunity to stand out.

How can estate planning actually grow an advisor’s business?

Advisors who lead with estate planning position themselves as trusted guides for entire families, not just individual investors. This creates:

-

Differentiation in a product-heavy industry

-

Referrals from attorneys, CPAs, and satisfied families

-

Generational stickiness by engaging heirs long before assets transfer

What tools help integrate estate planning into holistic planning?

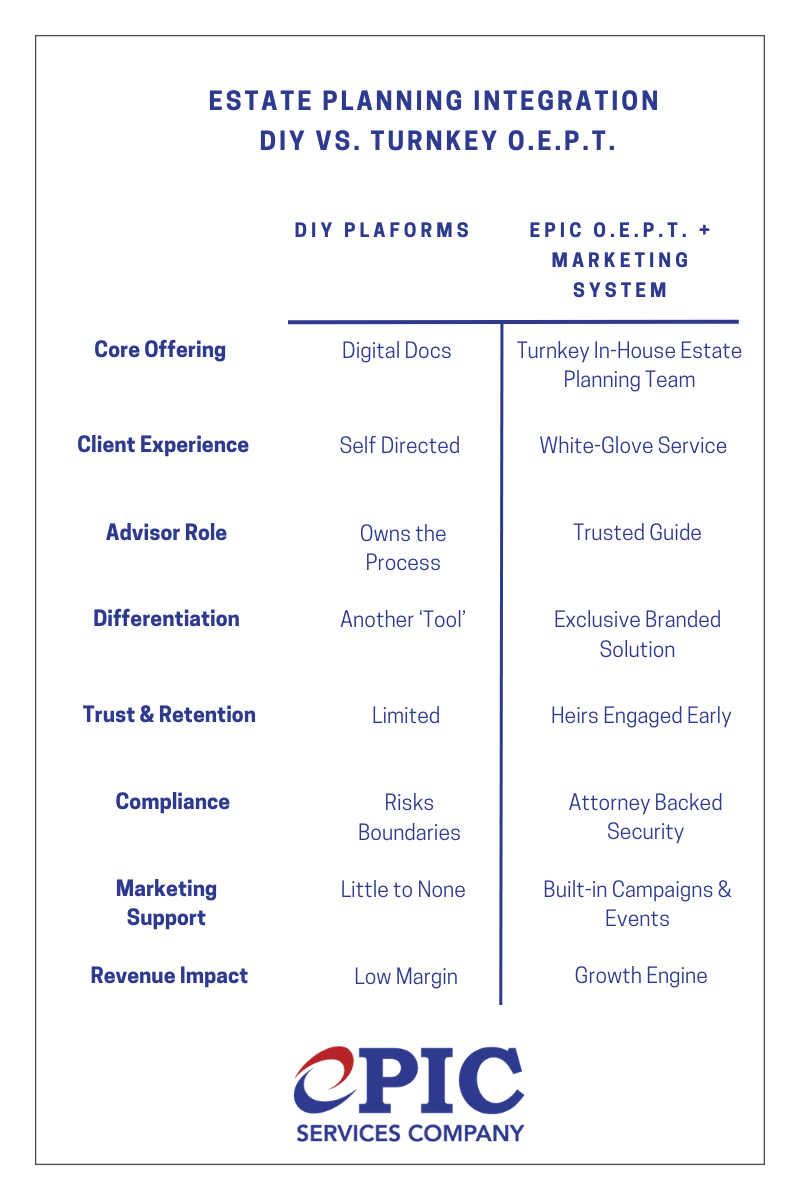

Digital estate platforms like Trust & Will, Vanilla, and Wealth.com provide basic wills and trusts. These tools can check the box, but they may not help an advisor build long-term client loyalty.

The alternative is a turnkey solution. ePIC’s OEPT + Marketing System integrates a full outsourced estate planning team with advisor-facing marketing campaigns. This positions advisors as the central hub of the estate process while removing compliance concerns.

Here is a visual comparison:

How do you introduce estate planning into client conversations?

-

Start with empathy: “What legacy do you want your family to remember?”

-

Use life events like marriage, a new child, a business sale, or retirement as natural prompts.

-

Show that estate planning is not a separate service but part of your holistic promise.

In conclusion, holistic financial planning is incomplete without estate planning. Advisors who claim to be comprehensive but skip this step risk losing clients, heirs, and future business.

Estate planning is not only about documents. It is about creating a bridge of trust that protects families, retains assets, and reinforces the advisor’s role for generations to come.

If you are ready to position yourself as a truly holistic advisor, book time with our team and find out how you can start with estate planning. The future success of your business may depend on it.